From Mother Jones:

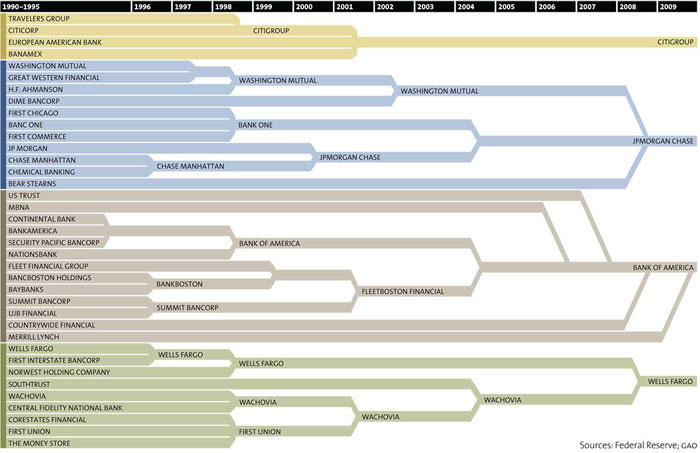

The nation’s 10 largest financial institutions hold 54 percent of our total financial assets; in 1990, they held 20 percent. In the meantime, the number of banks has dropped from more than 12,500 to about 8,000. Some major mergers and acquisitions over the past 20 years:

It might look like a sports bracket, but competition requires competitors and 33 of these players aren’t coming back next season. The object is to best other companies, not eat them.

For a similar look at the investment banking game, see the New York Times’ Wall Street Vanishing Act chart.

[Chart from Mother Jones via /r/Economy]

Banks Saying Sorry (or What You Won’t Find When You Open Up Your Letterbox Tomorrow) » Ape Con Myth

[…] Bank of America via Forbes] [Related: Hungry, Hungry Hippos (or Banking Mergers 1990-2009] Share: Add comments Filed under […]

Ask the I Ching: Should We Break Up the Big Banks? » Ape Con Myth

[…] situation has been about appearances. Bigger was thought to be better and so many banks became four. But there is no too big to fail. The bigger they come, the harder they fall. That’s […]