Former Citigroup CEO Sanford “Sandy” Weill has ruffled some feathers by suggesting that we should break up the big banks, separating investment banking from commercial banking as was the law under the Depression-era Glass-Steagall Act. It’s definitely an interesting idea coming from “The Shatterer of Glass-Steagall,” particularly since he didn’t agree in 2010 when his former co-CEO at Citi, John Reed, apologized for his part in taking down the act.

Plenty of people are going to weigh in on the subject now, but how about we ask a source that hasn’t been a player in tanking the world economy?

Enter the I Ching…

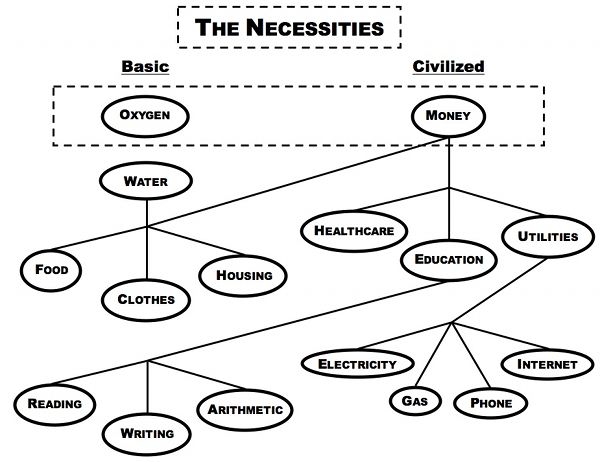

The adornments must be stripped away. Sounds a little bit like something you’d expect to hear from an ancient oracle, but that’s what it is.

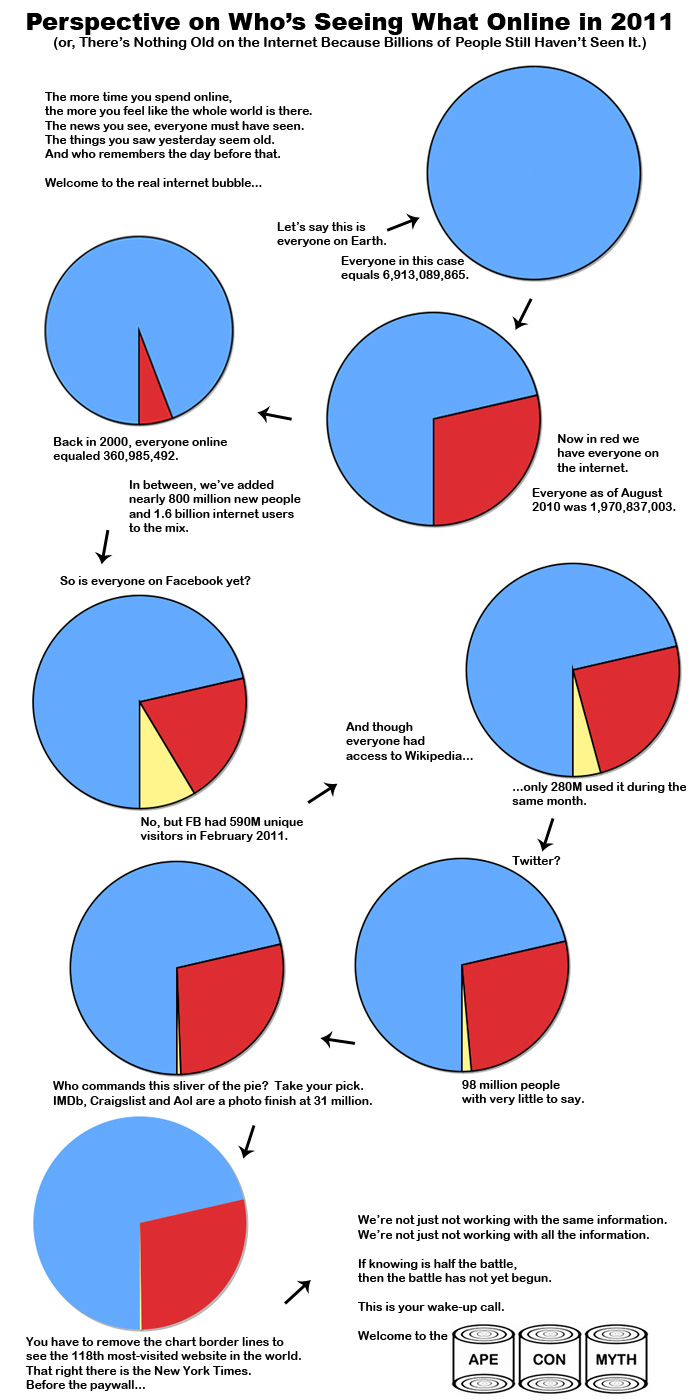

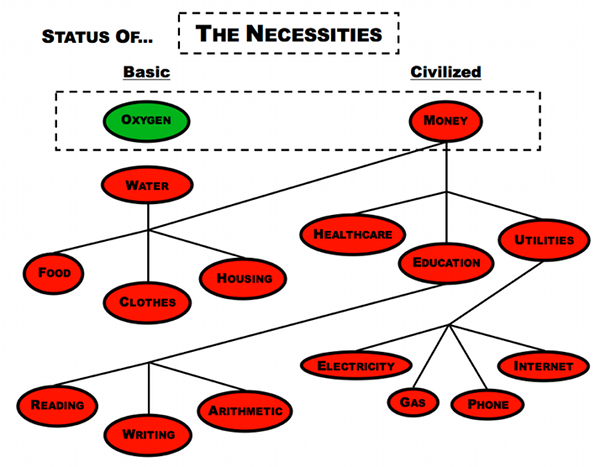

The situation has been about appearances. Bigger was thought to be better and so many banks became four. But there is no too big to fail. The bigger they come, the harder they fall. That’s general policy.

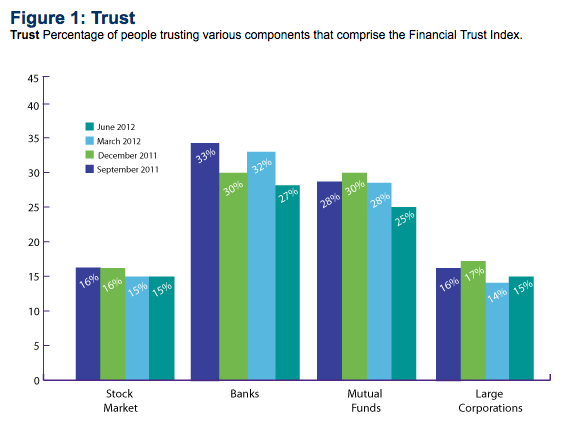

Substance is more important than packaging. If only the banks had consulted the I Ching before slicing and dicing all those mortgages. And before they turned from stodgy suits into wild gamblers. It took pushing us to the edge to do it, but trust in these institutions has faded.

Strip away the dead wood. Perhaps it will be the Safe, Accountable, Fair and Efficient (SAFE) Banking Act that reigns in leverage and places a cap on how big these dead trees can be.

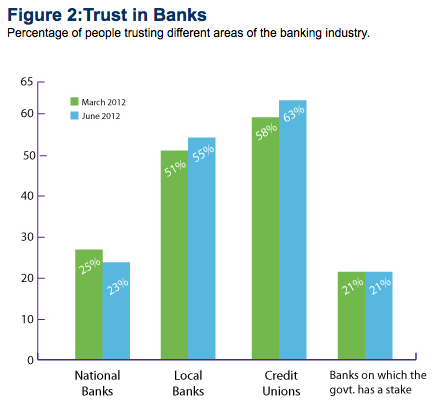

Rely on our own simple efforts. Like a few other industries, trust is flowing to local alternatives where profit and expansion aren’t the primary concerns.

Or at least that’s one interpretation. You could read more about the two hexagrams above with the Wilhelm translation to dive further into this reading or check back with the I Ching to see what it thinks today.

[I Ching reading via Psychic Science, Trust charts from the Chicago Booth | Kellogg School’s Financial Trust Index]